Plus – Find out how to completely avoid them!

Payment processing companies are a dime a dozen. But, navigating the transaction fees can be a daunting and challenging endeavor. When it comes to choosing a reputable credit card processor, understanding the small print is key. So, before you take the plunge, with any credit card processing company, it is important to consider these three important factors.

1. Watch out for ballooning processing fees

When it comes to credit card processing, one rule of thumb rings true: the more credit card transactions you process, the more money they make on their end. Many credit card processors charge a percentage depending on the volume of sales you make in a given month. On average, you can expect to pay 1.7% of your gross credit card sales, but this figure can go up to 3.5% or more. Generally, the more credit card transactions you do, the lower your transaction fee. But, buyer beware, a smaller percentage of a large number may sound good on the surface, but it could still account for thousands in credit card processing fees.

It is important to note that other factors can also play a part in how much you are charged for each transaction. In some cases, you may be charged a flat percentage, regardless of the volume of sales you do each month, but then have to also pay a per transaction fee on top of that. When choosing a credit card processor, you must do your due diligence and understand how their processing fees are structured, how they may fluctuate and estimate what this could mean for your bottom line.

2. Hidden fees could be everywhere you turn

Processing fees are only one small part of the cost equation for your business. When you use a credit card processing company, you want to always read the fine print and calculate all of the small incidental fees you may be charged per month. Here are three often overlooked fees that you should consider when deciding on which credit card processor to go with.

Application Fee. Credit card transactions have to be handled with care as to not expose your customer’s most sensitive data. Many credit card processors will charge an application fee that covers their review of your initial application and in determining if your business fits their customer profile. This could range from $100 to $500, depending on the size of your business and/or the level of risk involved with processing your credit card transactions.

Set-Up Fee. Some merchant account providers will charge you an initial setup fee, that often covers the cost of the credit card terminal that you’ll use to process payments. There may also be an ongoing monthly fee that then covers certain features or services such as technical support, security firewalls, and PCI compliance.

Early Termination Fee. Watch out for restrictive contract agreements. To lock in a competitive transaction rate, you may have to sign a one- or two-year contract. If you decide to leave, you may be stuck paying a hefty early termination fee. Credit card processors do this to prevent you from going from merchant provider to merchant provider, getting an even better rate with each switch. Be sure to ask before you commit to any one credit card processor and determine what fees, if any, will apply should you want to end your contract. Always ask for specific contract details and a written copy of your contract for you to review, before locking in any promotional rates. Whenever possible, opting for a no-commitment arrangement is best to prevent having to pay unnecessary fees, if and when you want to change providers.

3. Not all credit cards are made equal

Whether your customer is paying with a Visa, a MasterCard, or American Express, it will impact the size of the transaction fee you pay. With major credit card brands, they set the rules for how their cards can be used and how payments can be accepted. Since they run the networks that these payments will pass through, they can also establish how much each transaction costs. For your credit card processor, if they want to work with these major networks, they have to follow their rules and pay their fees – no questions asked.

It is important to note that the guidelines put in place by these major credit card companies are just that…guidelines. They aren’t hard and fast laws, but if your credit card processor is not abiding by them, they could be opening themselves up to costly liability and fines. Depending on the card types you accept, your credit card processor may have to be adhering to a host of different rules and fees.

Different credit cards have different interchange and assessment fees which could impact how much you pay. Many businesses do not accept Discover or American Express for this very reason, as the rates associated with these cards can be quite expensive.

Bonus Tip: How you process credit card payments is important

When it comes to credit card transactions, they are not all made equal. There are many ways to process credit card payments, whether it be over the phone transactions, an in-person swipe payment, or a recurring credit card transaction. Either way, how you accept credit card payments can play a part in how you are charged for those transactions. When it comes to navigating the cost for various payment methods, it is important to consider the level of risk associated with each.

For example, if your credit card information has been compromised and exposed to hackers, it is much easier for them to process a payment using your card number if it is done over the phone or solely online. There are very few verification processes in place for these types of transactions. However, if a customer makes an in-person purchase, they will have to have the physical card present to swipe at the terminal and they could provide identification to verify that they are the cardholder. Credit card processing companies have to navigate this risk and often do so by including additional surcharges for e-commerce and over-the-phone credit card transactions. So, if the bulk of your credit card transactions are from either of these two sources, then be sure to double check what fees may apply.

Is there a solution to completely avoiding these fees?

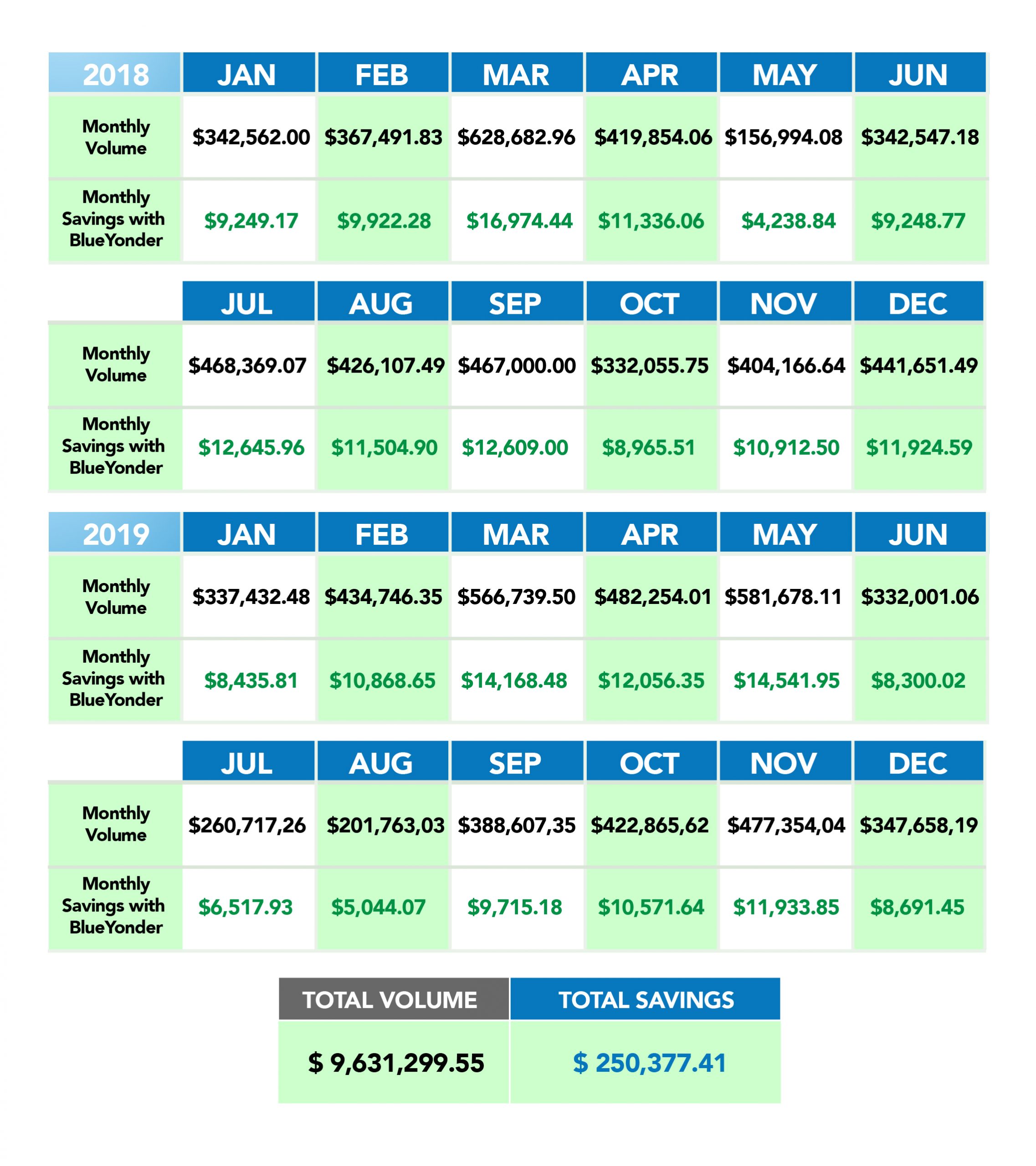

Completely avoiding all credit card transaction fees can seem impossible. However, businesses across the country are turning BlueYonder’s innovative processing model to save big on their credit card transactions. The card processing rules have changed, and you are no longer required, state or federally, to pay these fees.

With BlueYonder’s patented and legally compliant program, instead of paying transaction fees that can balloon out of control, BlueYonder only charges a flat fee of $65 per month for unlimited processing. Whether you have $10,000 a month in processing or $1,000,000 a month in card processing, you pay only $65 per month.

There are no start-up fees, no long-term contracts, no transaction fees, no cancellation fees, and best of all, no hidden fees. And, to get you started, they provide you with their patented plug and play terminal, shipped directly to you, at no cost, compatible with any POS system. Available for VISA, MASTERCARD, AMEX, DISCOVER, APPLE PAY and ANDROID PAY.

To see how much Blue Yonder can save your company,

![]()

Interchange fees are the underlying cost of processing a credit card sale. This is one of the single most important factors that will influence your transaction fees. When you swipe a customer’s credit card there are a host of entities that are involved with executing the transaction, including the merchant service provider, the card-issuing bank, the credit card association (Visa, MasterCard, Discover, or American Express). It is the credit card association or network that sets the interchange rates and fees. For every credit or debit card transaction, there is a pre-set rate that the merchant service provider is required to pay. The rate can fluctuate with some cards having a higher rate while others have a lower rate. One general rule of thumb is that the interchange fee is often directly related to the cost that each bank has for the respective card. For example, cards with lots of consumer perks or bonuses often have a higher cost to the card-issuing bank to recoup, therefore the interchange fees for these cards are usually higher.

Interchange fees are the underlying cost of processing a credit card sale. This is one of the single most important factors that will influence your transaction fees. When you swipe a customer’s credit card there are a host of entities that are involved with executing the transaction, including the merchant service provider, the card-issuing bank, the credit card association (Visa, MasterCard, Discover, or American Express). It is the credit card association or network that sets the interchange rates and fees. For every credit or debit card transaction, there is a pre-set rate that the merchant service provider is required to pay. The rate can fluctuate with some cards having a higher rate while others have a lower rate. One general rule of thumb is that the interchange fee is often directly related to the cost that each bank has for the respective card. For example, cards with lots of consumer perks or bonuses often have a higher cost to the card-issuing bank to recoup, therefore the interchange fees for these cards are usually higher. Tiered merchant account pricing is a common fee that most merchant providers charge. However, this is where a lot of the hidden fees occur since how tiered pricing is determined or what rates are charges can change from one provider to the next. Unlike interchange fees that are set by the credit card networks, tiered pricing is determined solely by the merchant provider and can be influenced by a variety of arbitrary factors.

Tiered merchant account pricing is a common fee that most merchant providers charge. However, this is where a lot of the hidden fees occur since how tiered pricing is determined or what rates are charges can change from one provider to the next. Unlike interchange fees that are set by the credit card networks, tiered pricing is determined solely by the merchant provider and can be influenced by a variety of arbitrary factors. Before you sign a contract with a merchant service provider, it is critical to understand what rates or penalties are associated with canceling the account, at any point. Cancellation fees are not set by an industry standard, instead, every merchant processing provider sets their own cancellation fees and requirements. Keep in mind that cancellation fees can run from $200 to a few thousand dollars, depending on the contract details.

Before you sign a contract with a merchant service provider, it is critical to understand what rates or penalties are associated with canceling the account, at any point. Cancellation fees are not set by an industry standard, instead, every merchant processing provider sets their own cancellation fees and requirements. Keep in mind that cancellation fees can run from $200 to a few thousand dollars, depending on the contract details.