This case study focuses on a current BlueYonder merchant.

Client: High profile Plastic Surgery Center located in Newport Beach, California.

Their procedures range from $1,500 to $35,000.78% of all their procedures are run on their patient credit cards.

Key problems client was looking to solve: |

- Client’s processor was charging an average of 2.5% a month in

processing fees. - Client was spending $9,000 to $16,000 every month in processing fees.

Totaling more than $120,000 in credit card processing fees per year.

Solution: |

- BlueYonder gave instructions on proper set-up an implementation of program.

- Given examples of how other plastic surgery practices run BlueYonder.

- BlueYonder suggested 3-month test pilot.

Action: |

- Client opted to test BlueYonder starting in January 2018.

- BlueYonder set up Virtual Terminal at no cost and no contract. Provided collateral and staff training.

- Client was advised to not cancel their current processor during test pilot.

Results: |

- After 1 month of running BlueYonder, client canceled their expensive processor. Client continues to run program today. Client has never

experienced any issues from a single patient since beginning program. - Client pays $65 a month for unlimited credit card processing with no other fees.

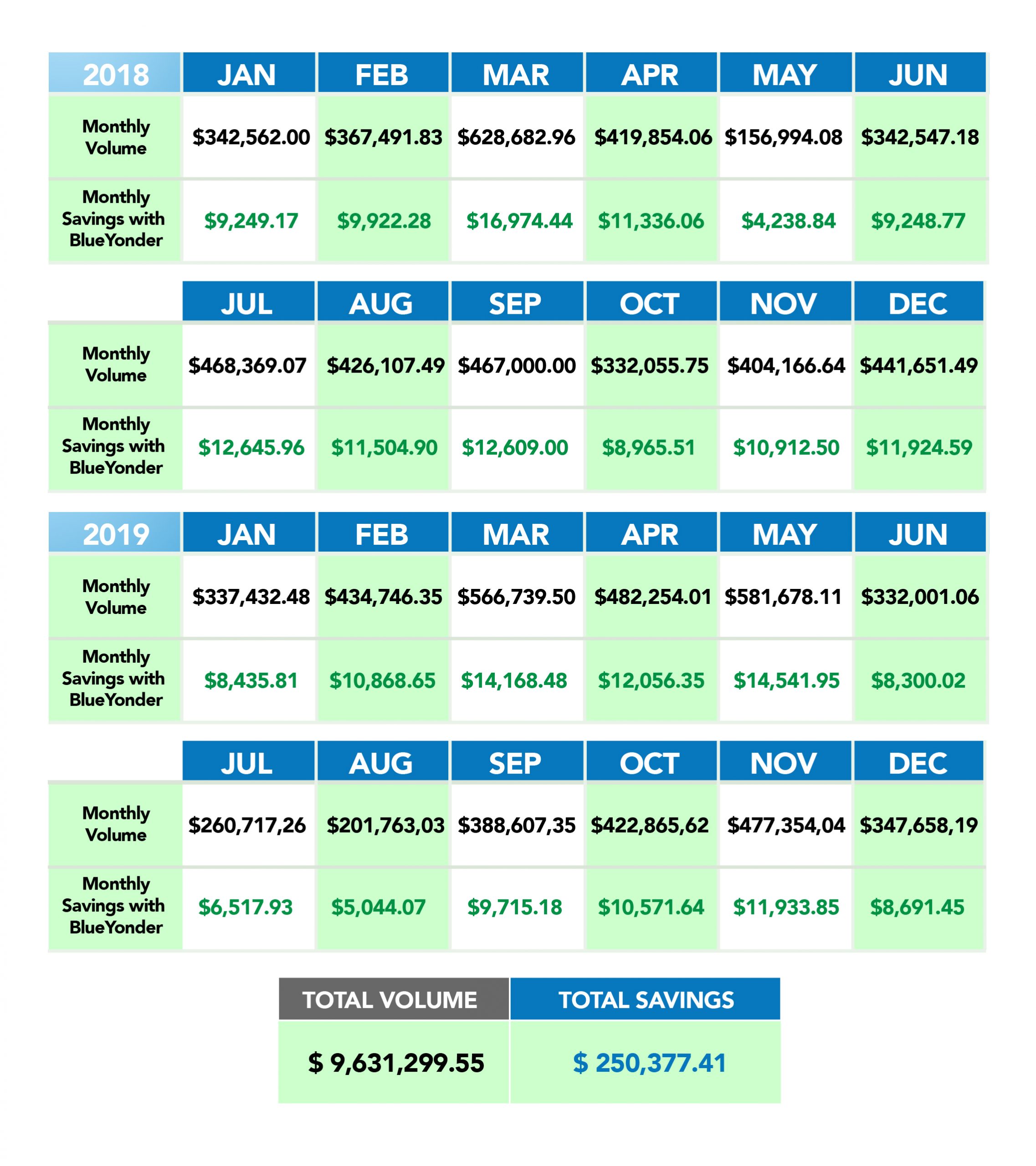

- In client’s first 24 months, their business ran $9,631,299.55 in credit card processing. Saving a total of $250,377.41 in fees.

The chart below, shows clients month by month savings.

No matter what type of medical practice you own, if you take credit and debit cards as a form of payment, BlueYonder’s credit card processing program will work for you. It is a simple fix. Nothing changes in your practice except the high volume of savings you will enjoy. Many of our medical practice enjoy savings we have shared in this case study.

If saving $50,000 to upwards of $200,000 a year is relevant to you and your business, give us a call.

We will transparently walk your through our program.

You have nothing to lose and you can test our program with no commitment.

To see how much BlueYonder can save your practice, call at 800-270- 9285

or use this Contact Form