Fact: BlueYonder is $65 a month for unlimited processing. No other fees.

Is using BlueYonder right for your business?

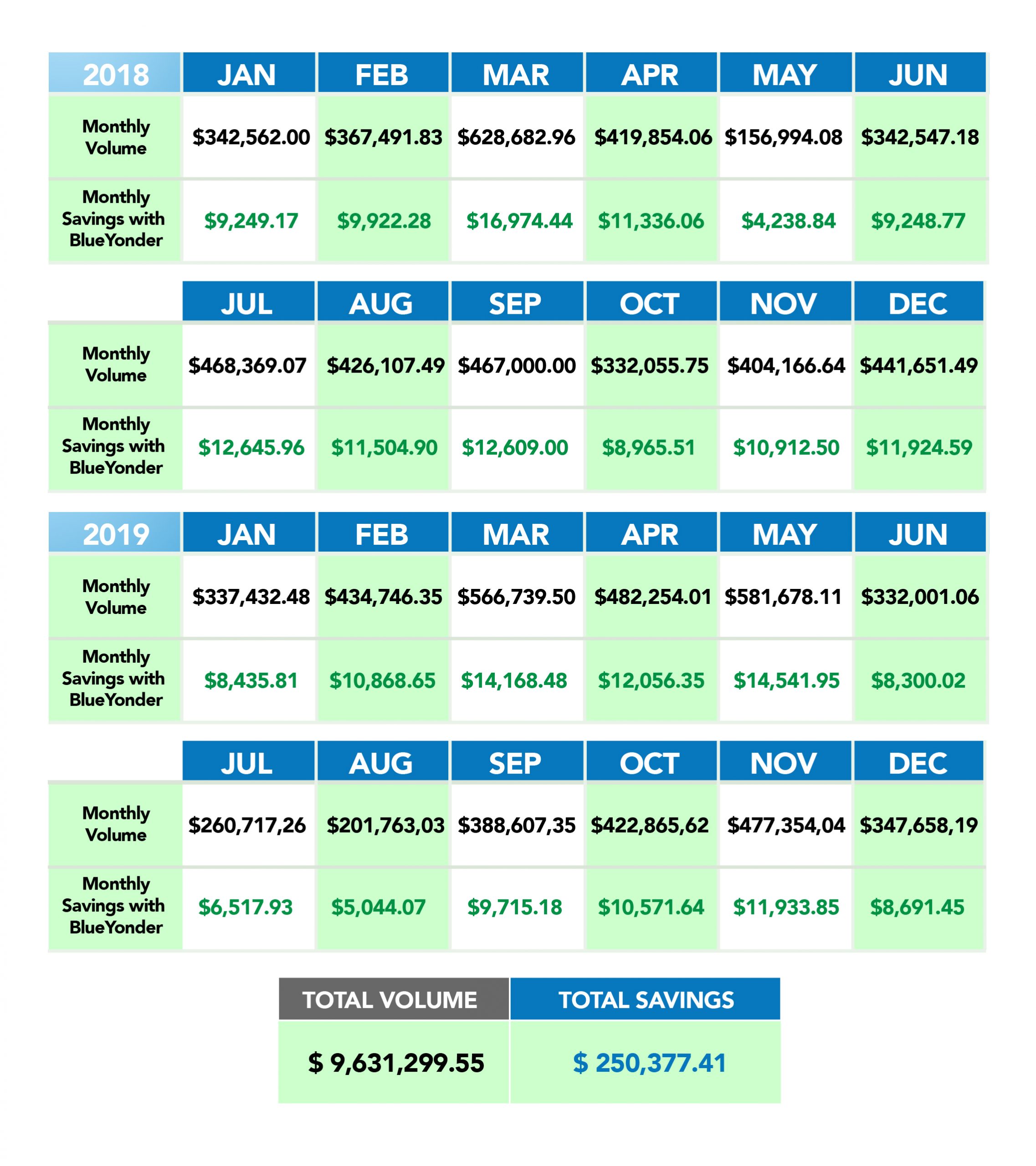

To answer this question, let’s have a look at your credit card processing numbers.

For most businesses, when you include ALL the fees your processor charges, you pay 2.2% to 2.8%. In the chart below, we use a conservative 2.5%. The chart below reflects what you are currently paying to process cards this month. And over the next 5 years.

Study this chart, find your monthly volume of card processing and go from left to right. Whether you’re a big business or a small business, your processing costs add up quick.

*Chart below reflects your current 2.5% processing costs

As you are aware, these processing costs are occurring in REAL TIME. With BlueYonder you can reclaim this revenue.

Our technology enables you to pass the processing fees to your customer. In compliance with card processor regulations on state and federal levels.

With BlueYonder you stop paying your high credit card processing fees and enjoy $65 a month for unlimited processing. No other fees.

![]()